Financial literacy — A broad overview

Money is not everything. Make sure you earn a lot before speaking such nonsense. - Warren Buffet

There may indeed be things that money can't buy. Sill, who thinks that money isn't relevant in life, probably grew up very protected.

Almost everything in life is easier with money than without. And even to enjoy the free things in life, you are better off with some level of financial stability.

Today I'll try to give a very broad overview of how to build financial literacy. I will divide the topic into the three sections: budgeting, investing and career.

Let's jump right into it!

Budgeting

No matter how much money you earn, if you spend it faster than you make it, that's a sure way to become miserable.

For most of us it's not that dramatic. Nonetheless, budgeting is a first essential step that allows us to gain clarity over our personal finances.

When people hear budgeting, that usually comes with a negative connotation. We think of frugal people (the ones who seem to live a very unsatisfying life just to save a lot of money). It's not about that.

It's not even necessarily about spending less. This step is about knowing what we spend our money on and how much of it. The goal is become intentional.

- Taking inventory

Get a blank paper and a pen –or an Excel sheet, if you are that typical economics student (i.e. you got more LinkedIn than Instagram contacts). Write down how much money comes in every month (your income). Divide that into budgets for different expenditure categories.

Be realistic. There is no use in planning especially low expenditures if you can't stick to your budgets. Spend more on things that are important to you.

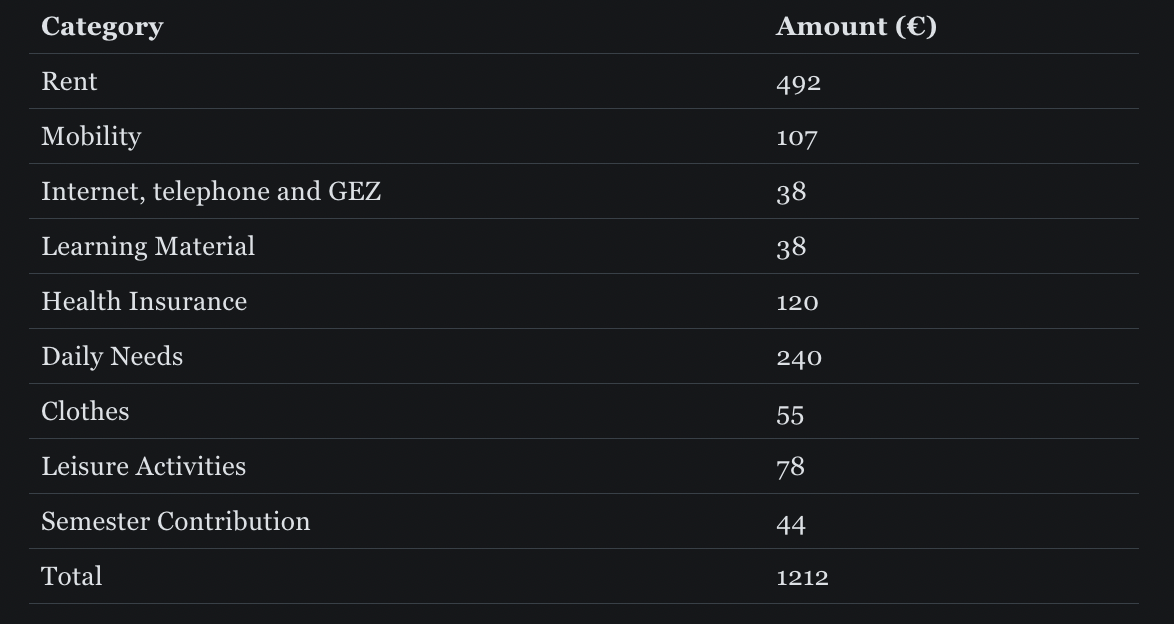

As an example, here is what a typical student spends monthly according to a social survey conducted by "Deutsches Studierendenwerk" [1]. The survey is from 2021, so I adjusted the numbers for inflation according to the German Federal Statistical Office [2]. With 2020 as the base year, price levels are now at roughly 120%.

Keep in mind that this leaves no room for unplanned expenditures like a back payment for electricity, buying gifts or travelling.

- Track your spending

Now, you worked out your finances in theory. This is a first good step. In practice, of course, everything is way different.

To get and to keep a realistic overview of your expenditures, you need to track them. There are different ways to do it.

You could keep a budget planner (dt. Haushaltsbuch). Either a messy one on paper, or a slick but complicated one in Excel (or google sheets). For the letter, you find comprehensive tutorials on YouTube. The good thing is, it's free. The bad thing is, it's tedious to manually write down things you bought.

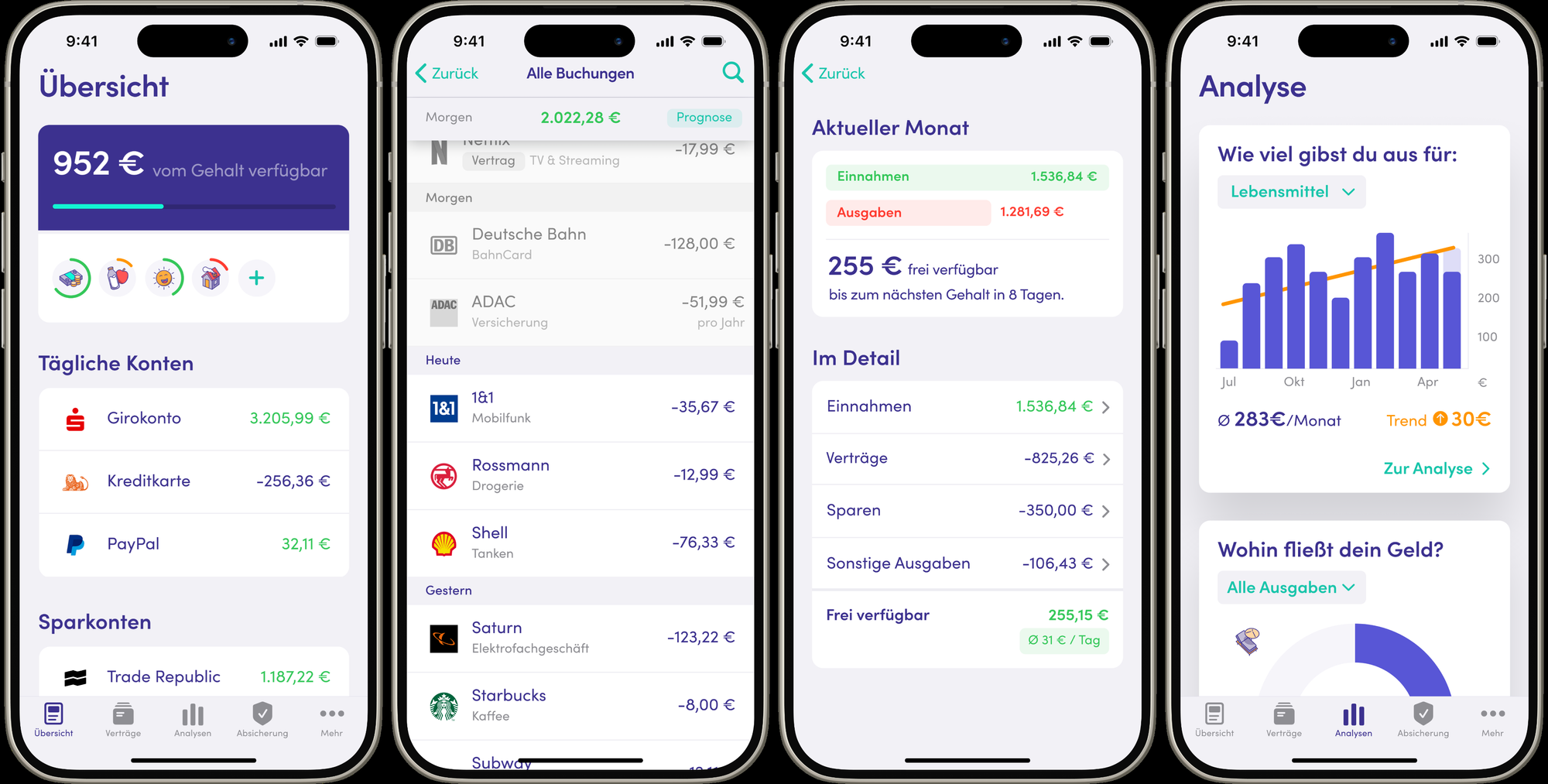

An automated way to keep track of expenditures comes in the form of apps. A very simple one is FinanzGuru (not sponsored). You connect your bank account and set up budgets. Everything you buy (using credit or debit card) will be tracked automatically and sorted by your budgets. I currently use it for €2.99 a month.

Over time, you can adjust your budgets to your needs or change consuming behaviour that you don't like.

Saving and Investing

Now, for anything big that we wish for–like travelling Asia or buying a house– chances are we need to save or even invest to make it happen.

Let's start with a distinction between both. By saving, we mean putting money on the side, usually on a deposit account (dt. Tagesgeldkonto). This comes with low risk but also low returns. We want to save, if what we save for is in the near future (less than 5 years from now).

Before we think about investing, first we want to save for an emergency fund. It should be around 3–6 months of your living expenses. For our student above, this would mean around €3.600.

That's because investment vehicles always come with risks, and one of them is volatility. Their value goes up and down over time. Even if we invest into things like total market index funds (where total loss is unlikely), they could lose substantial amounts of their value due to business cycles in the economy. If we are forced to sell during an e.g. 5-year period where they are down 25%, we lose money.

General advice is that you should not invest money into stocks or funds made up of stocks when you need that money within the next 10 years. The longer the time horizon, the better you can take the volatility.

For most people, it is considered good advice to invest in ETF or exchange-traded funds. There are different ones, and some are not advisable at all. Do your own research before you invest.

A beginner-friendly book is "Das einzige Buch, das Du über Finanzen lesen solltest" by Thomas Kehl and Mona Linke. In addition, Ben Felix has a very extensive series on ETF investing on YouTube.

Of course, there are many other strategies to investing –which work for some. Since this article aims at beginners, this is not the right place to discuss them. Most people that try to outperform the overall market–by not using an ETF strategy–actually do worse.

Career

If you want to change your financial situation substantially, this is where you should apply most of your effort.

How much you save is limited. You can only save so much of what you earn. How big of returns you can get on your investments–for most people–also is fairly limited. If you are already invested, the only way to reach higher returns on your invested capital is by taking bigger risks, that you are then being compensated for. What is less limited is how much you earn.

First, you can strategically think about what job you want to pursue. You can use websites like StepStone to look up the expected salary for different jobs that you are interested in. Do they fit your salary expectation? There are sectors who pay better than others.

Second, if your goal is to become wealthy, you should not only consider in what sector you want to work, but also the business model. If you work a typical 9-5 job, you trade time for money. Since you have a limited amount of time, you can only earn a limited amount of money.

Naval Ravikant describes three different forms of leverage working. From least to most leverage:

- Capital – You can invest and earn money regardless of your time.

- Labour — You can hire employees to build a product or provide a service.

- Products with no marginal cost of replication – Code or Content. Both are theoretically indefinite scalable.

And third, investing in your human capital. The younger you are, the higher the returns on that kind of investment. At the same time, I don't believe there is an age or phase in life where you no longer profit from learning.

My favourite way to learn is by reading books. But there are many more ways. Skills are just as important. As long as you work for others, it's also important to not just be capable, but look capable to potential employers. You need proof. The best way to show that you are who you say you are in the business context is by doing internships.

Today I told little about a lot of things. But my goal was to set a foundation on which we can build on with future articles.

Is there a finance topic that you would like to read about? Let me know! If you know someone who could benefit from this article, let him or her know!

Until next time!